LIQUID MARKET PRODUCTS

Liquid markets offer great opportunities to invest into the global economy by still being able to control the long-term risk/reward ratio.

Besides our tailor-made asset management solutions offered by our advisors in close cooperation with our clients, FINAPORT offers a systematic investment strategy based on academic research. Statistics show the best way to achieve great results: Well diversified, free of currency risks, cost efficient and without emotions.

Our systematic strategy is offered in USD, EUR, CHF and GBP.

change currency on charts

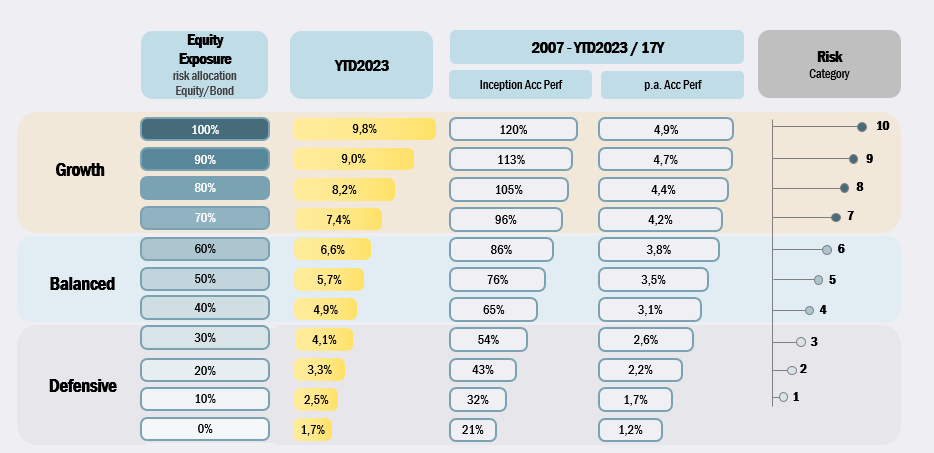

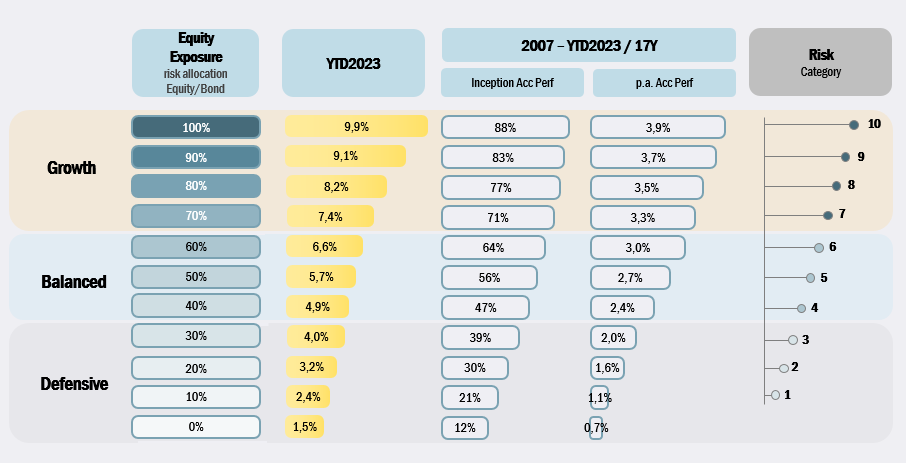

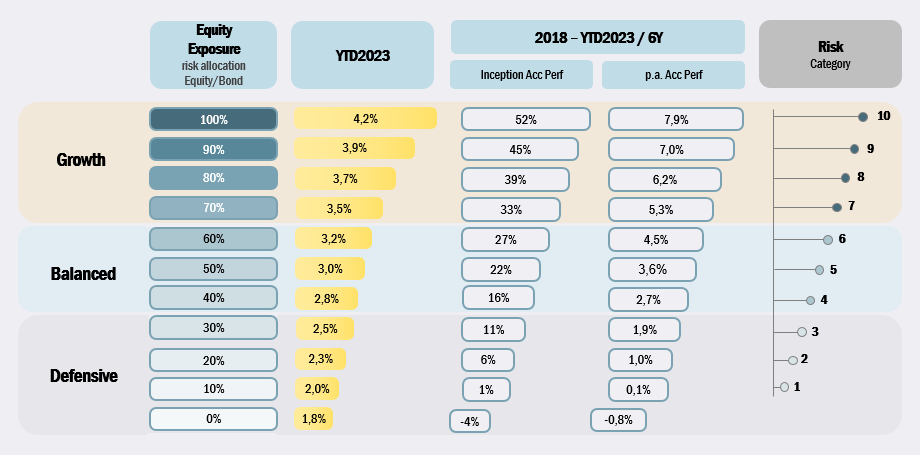

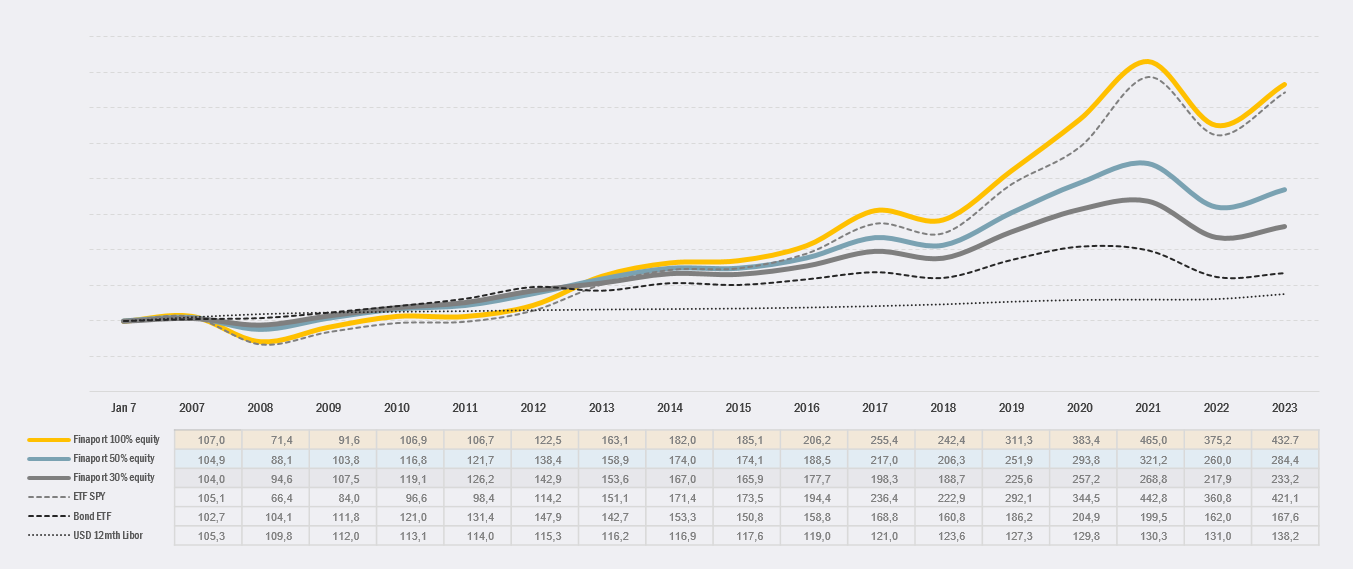

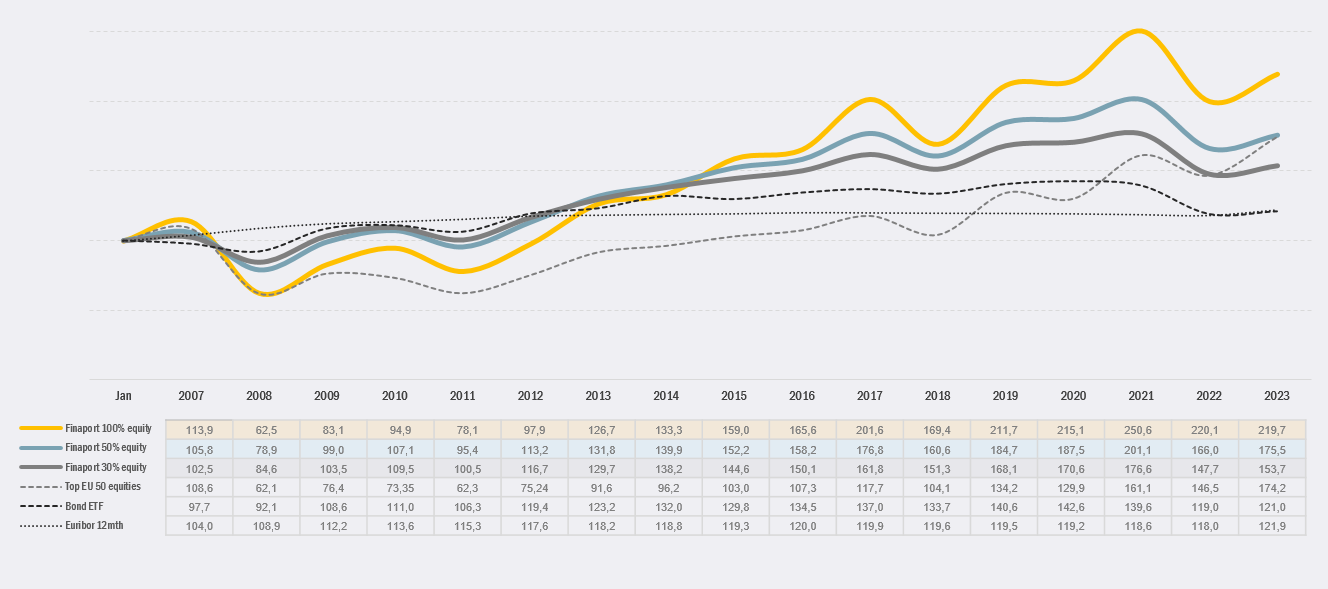

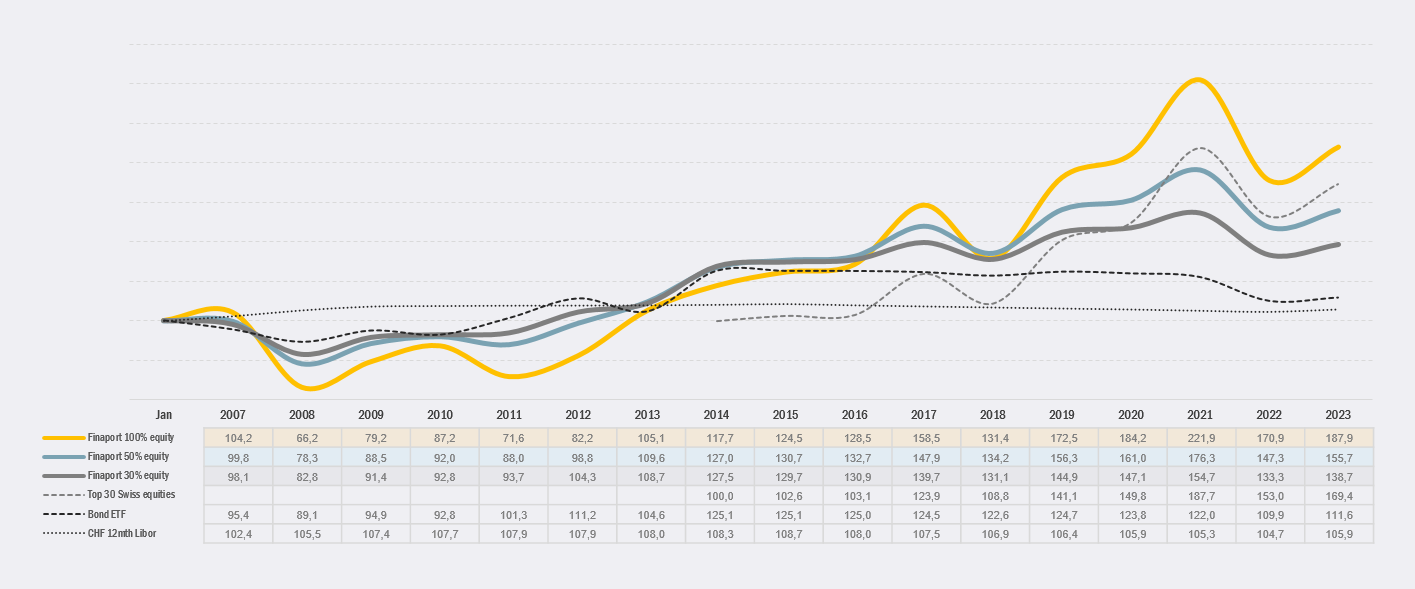

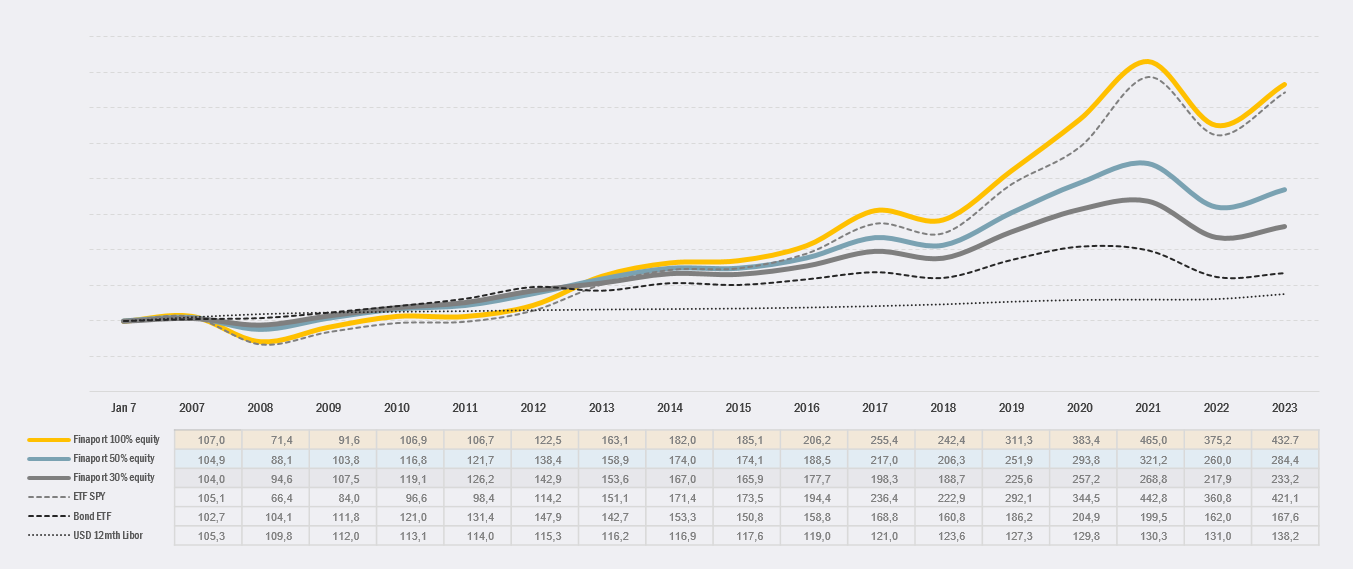

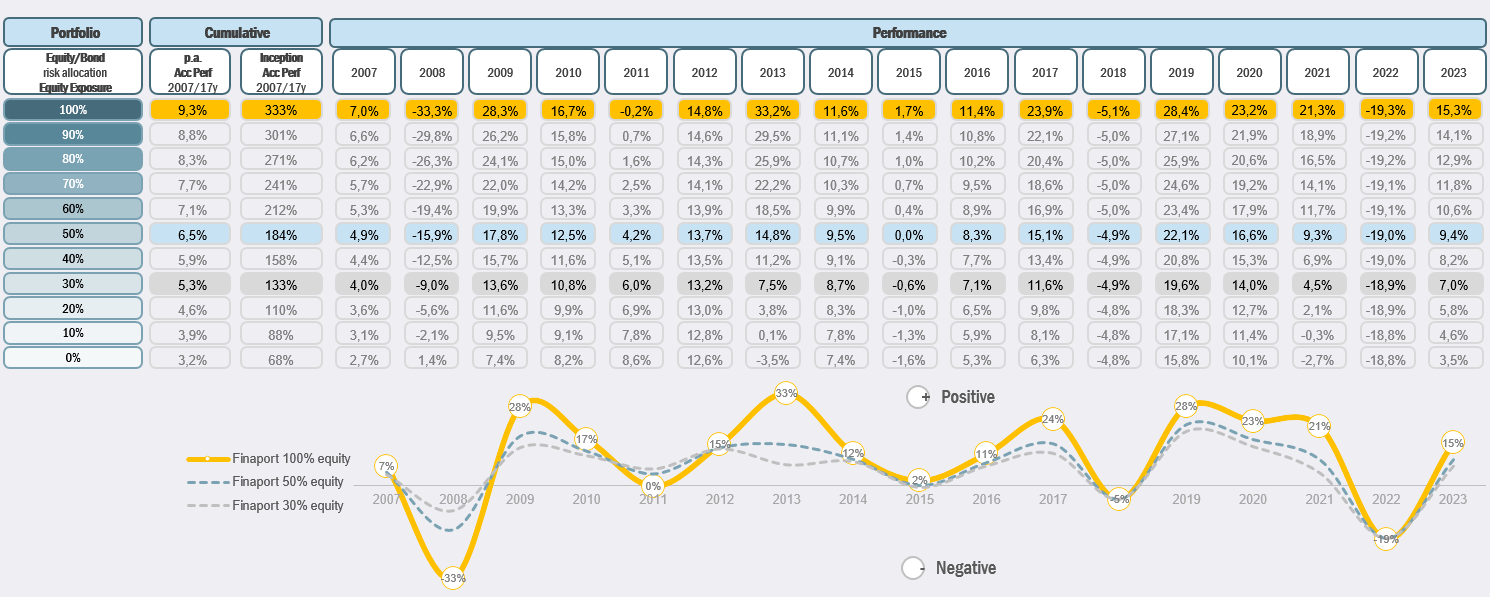

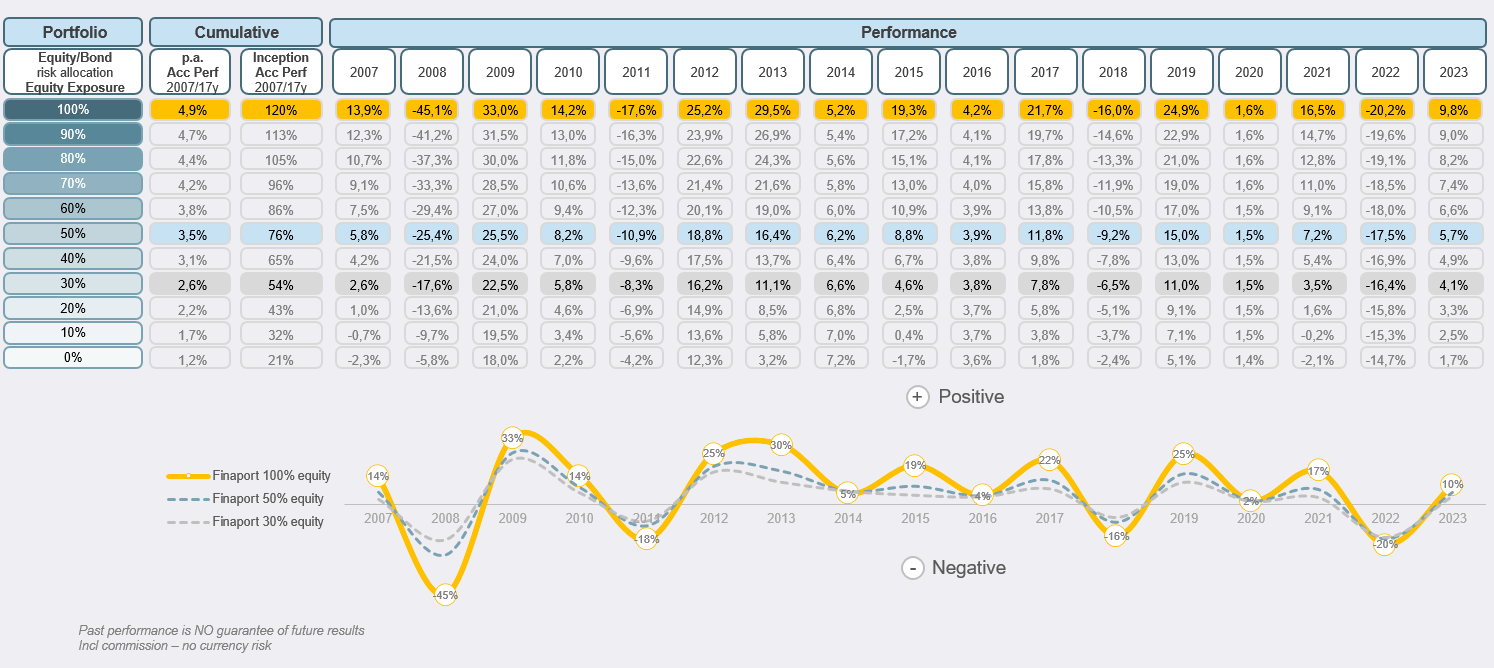

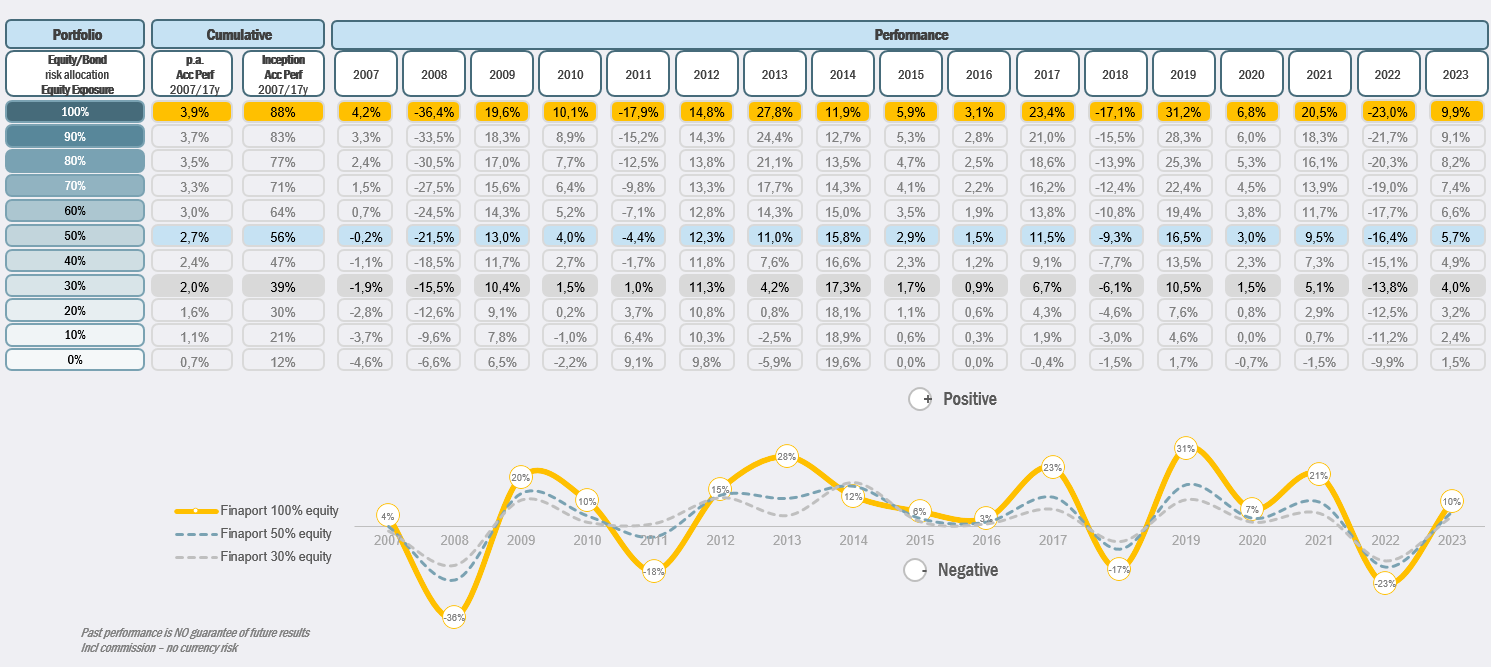

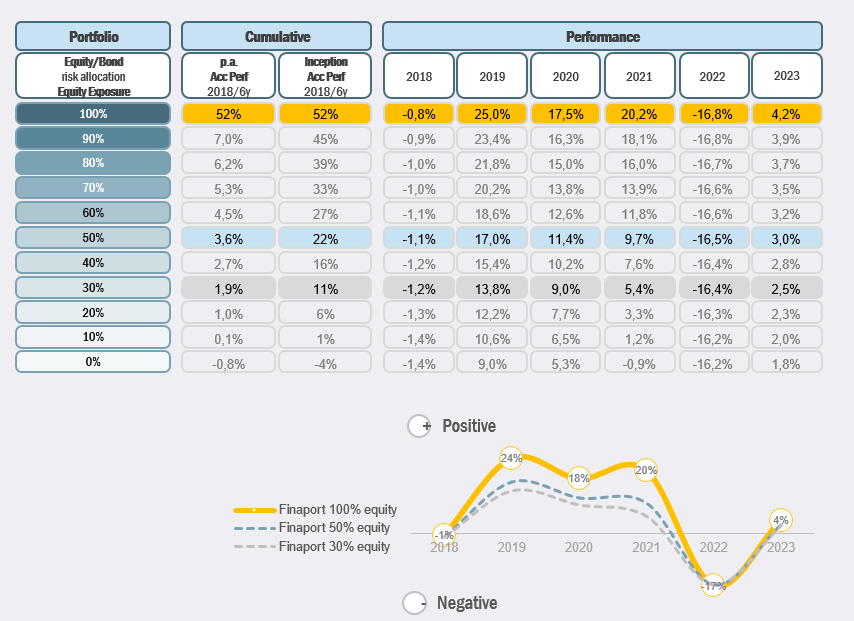

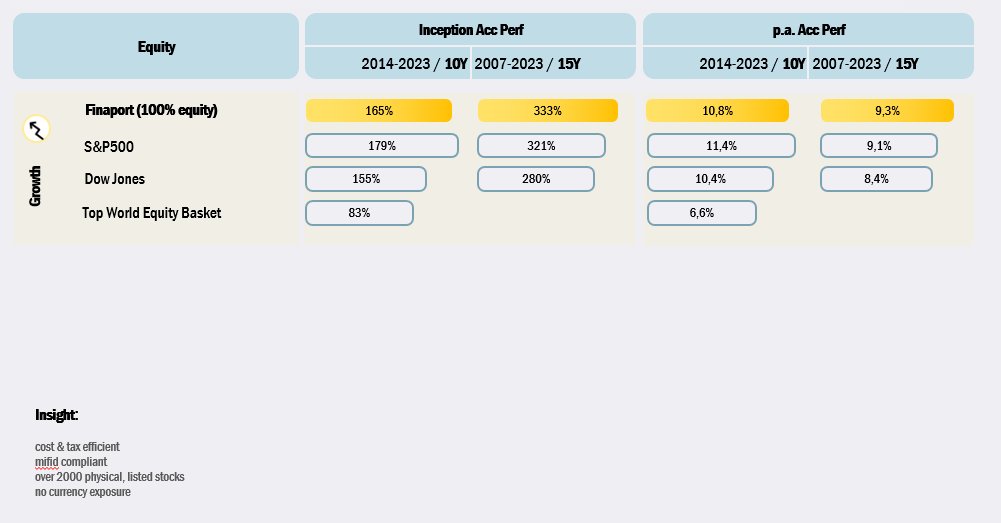

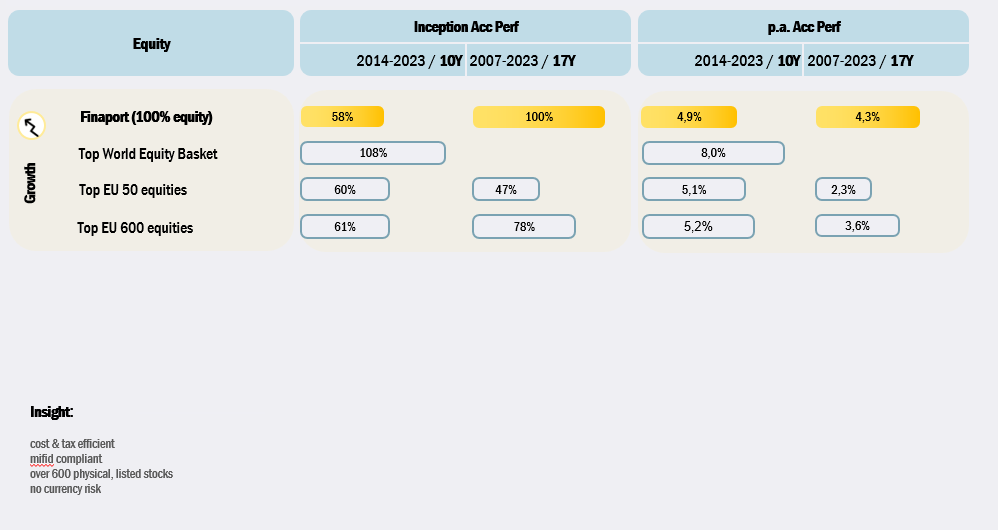

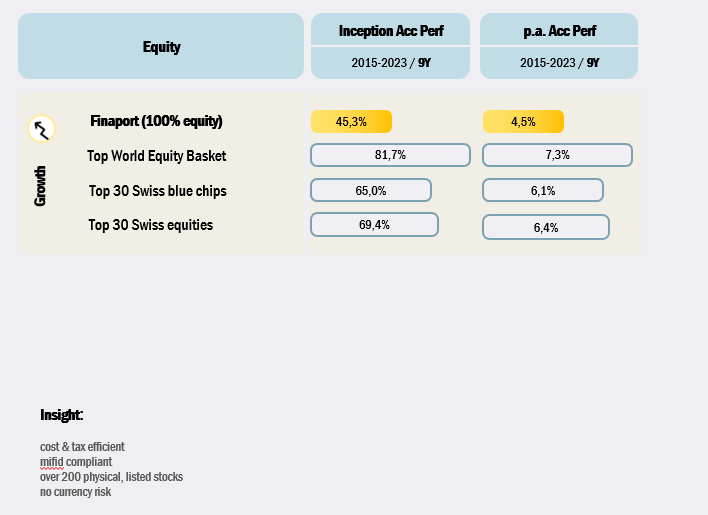

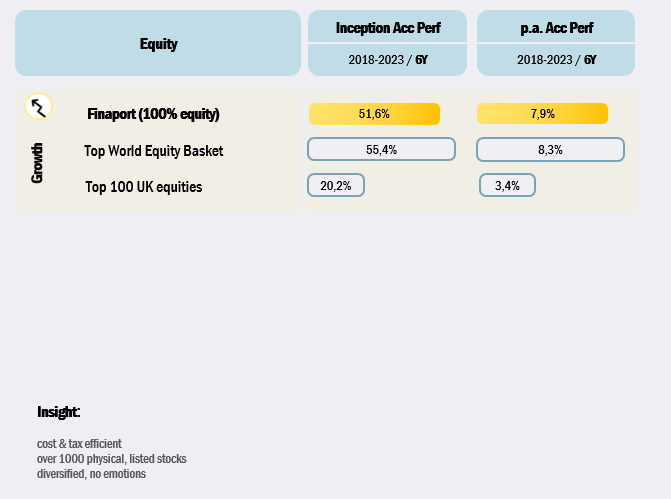

US – USD Portfolio (2007 - June’2023)

US – USD Discretionary Mandate Performance 2007 -2023

US – USD Discretionary Mandate Solution

US – USD Equity portfolio

FAQ Systematic Asset Management

What is your investment strategy in the Finaport Mandate solution based on?

The investment strategy of our analysis is based on the reality that nobody can predict the world economy in the long term. Therefore, it is also impossible to make forecasts about the development of financial markets.

What factors influence a successful investment strategy?

There are two main themes. On the one hand, we have the emotional aspects. On the other, the products and their diversification combined with their daily liquidity.

What is the focus of your investment strategy?

Our investment strategy is based on a systematic, rule-based approach. No tactical allocations or daily trading. Everything focuses on risk / return.

What kind of investments are you focusing on?

We focus on passive investments. Through the targeted selection of our investments, we obtain well-balanced portfolios. This means that we create our own indices and receive portfolios with up to 5000 physical securities.

Why don't you buy any commodities?

Gold or commodities in general are individual investments for us and therefore we understand this as a bet. The risk to return is much too high. There is no return except the increase in value. Therefore, it is an emotional investment that has no place in our strategy.

Where is the added value in your investment strategy?

The added value lies first of all in the clearly defined investment strategy (systematic, rule-based). This is an essential point in our success. The second aspect is the investments in which we invest and lastly how we combine everything. We like to compare it with cooking. Not every cook is a good cook, even though they use the same ingredients.